Real pay stubs are written pieces of evidence that encompass and document details like the employees’ wages, deductions, plus all taxes imposed over a specific time period.

Pay stub is an efficient method that helps employees to keep a record of their finances and accounts so that these documented accounts can serve as evidence and resolve issues in the event of a conflict. However, there are chances that you might be scammed by a fake pay stub out there.

It is crucial that you get a real pay stub from authentic online sites, and if you are having difficulty finding one, this website is your jackpot. Now, let us take a look at the numerous benefits these real pay stubs provide before finding out whether they are necessary.

Benefits of Real Pay Stubs

Source:goodmenproject.com

There is no doubt that pay stubs are an imminent part of the employment period. Accounting and tallying can often be quite confusing for the employees, and these real pay stubs have written records that seamlessly help employees get accustomed to the process. You can find more useful information at ThePayStubs.

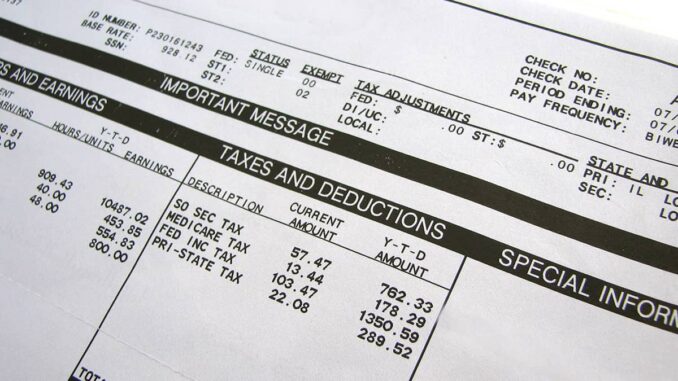

Finance details like the gross income, grants and additions, tax deductions, and net income are plugged into the real pay stubs once all the calculations are taken into account.

Apart from being a guide to employees, check stubs also help eliminate any kinds of discrepancies that might occur. It also helps maintain the transparency between the employer and his employee. This means that both the parties would not be getting any chances to cheat because nothing can get past the real pay stub records!

What information does a paystub need to record?

Source:checkstubmaker.com

We have seen that a real pay stub is quite helpful in simplifying the monetary and technical aspects, but this does give rise to a question. Are there any criteria that mandate the information and data that has to be recorded on a real pay stub?

The answer can never be specific enough because the information to be recorded on this pay stub differs according to the laws of the state you are working in. However, there is some general information that has to be listed on any kind of pay stub so let us take a look at them!

A real pay stub needs to contain all the employee’s personal information, such as his birth date, full name, age, marital status, and other details that they think are necessary.

Apart from the personal information, it also needs to include the gross wages, the taxes, and deductions, the number of hours worked, the rates paid, allowances and contributions, and finally, the net income.

The net income or net wages is the income that the employees actually receive once all these tax and deductions and allowances parameters are considered. If an employee gets a bonus or vacation pay, those records also must be filled and shown on a pay stub.

Does an employer have to provide the real pay stub?

Source:classlawgroup.com

This brings us to our main question. Yes, all the employers might be facing this same dilemma, so take a look and find the answer! There is no federal law that states that the employees must necessarily provide the real pay stub to an employee.

That being said, some of the states have made it compulsory for employers to maintain a check stub for all the company employees.

So, the first thing you as an employer need to do is check out the state you and your company are located in. Then you can check out the state laws, and if the state laws dictate that it is a necessity, you must adhere to it. If you fail to provide real pay stubs in these states, you might be fined heavily.

For example, in California, charges up to $4000 might be imposed on you, which depends on the department of labor. So, it is suggested that you do not take such risks.

If you are in a state where it is not compulsory to generate a real pay stub, it would not be a crime if you do not provide pay stubs to your employees. Some companies have a complex hierarchy structure that might make the maintenance of paystubs an excruciating process. In that case, you might have to hire an expert who can keep a record of all this data.

Employee and Employer agreements

As per federal laws, the employees must keep track of the payroll. Now, it is up to your company to decide whether you want to be involved in this documenting process. Although there is no compulsion for you to be involved in generating or maintaining this payroll or real pay stub, there are few things you must keep in mind before you make the decision.

Transparency between the employer and employee is crucial to any business. If there is no trust and openness, your company is bound to disintegrate, and a pay stub can be that element that helps maintain this much-required transparency.

Since all the details are listed out on the real pay stub, the employer and employee can always use them as a reference when they are unsure as mentioned before, it is an excellent method to resolve conflicts and ensure that your employee does not get paid more or less than what he deserves.

Besides, as a responsible citizen, you can also ensure that the records shown by your employee are genuine and do not contain any misleading data. This also decreases the chances of your employee evading taxes by providing a fake pay stub, and in return, it earns a significant reputation for your company.

Conclusion

Source:patriotsoftware.com

Well, now you have seen all the factors that are taken into account in deciding whether you must provide check stubs to your employees or not.

There are plenty of sites and companies that can also help you maintain these paystubs if you choose to help your employees out. Although it might be a tiring process, your employees would appreciate your supports, and you might just end up earning their loyalty!